Fairfax County Real Estate Assessments

Both Assessments & Tax Rate Increase Once Again

The Fairfax County Board of Supervisors announced the County Executive’s proposed budget for Fiscal Year 2019 is based on a tax rate of $1.155 per $100 of assessed value. $1.13 is Fairfax County’s current FY2018 tax rate. When the Board adopts a final budget in early May it can set the tax rate lower, but not higher, than what was advertised. The proposed General Fund budget is $4.29 billion, a $192.32 million (or 4.69 percent) increase over the current FY 2018 Adopted Budget. Including other appropriated funds such as federal and state grants, the total proposed budget is $8.42 billion. (Last year the budget increased revenue by $88.2 million, or 2.2%, over the FY 2017 Budget.

This budget includes a general fund transfers to Fairfax County Public Schools total $2.26 billion as requested by the School Board after accounting for an anticipated increase in state revenues. This is 4.38% or $95.10 million, increase over the current FY 2018 school budget.

Some of the key issues impacting the county budget:

¨ Restrained revenue growth anticipated for the foreseeable future. Expenditure needs will continue to outpace resources; fiscal constraint will be required.

¨ Focus on Board of Supervisors priorities; balance with available resources.

¨ Continued uncertainty about U.S. fiscal policy and impact of tax reform.

¨ County will continue to monitor the Commonwealth of Virginia’s budget and the impact on our local budget.

¨ County and regional response to address ongoing Metro funding requirements.

¨ A commitment to work collaboratively with FCPS to meet joint priorities.

Tax assessments can now be viewed online to see your own assessment and history. After last year’s whopping increase in both rate AND in assessed value, taxpayers will see additional increases in both areas.

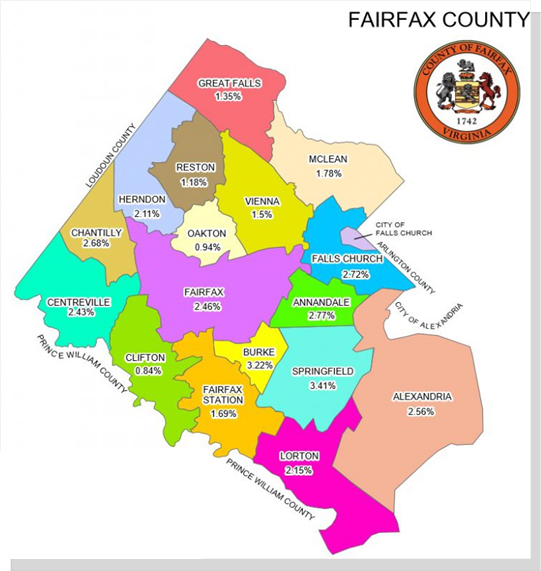

Fairfax County posts that approximately 64.5% of residential property in the county increased in value over the past year due to equalization, with an average increase of 2.17% Nonresidential real estate values (commercial, industrial and rental apartments) increased 3.79% on average due to equalization.

Of the 353,904 taxable parcels in Fairfax County:

¨ 259,444 have an assessment change

¨ 94,460 have no assessment change

¨ The breakdown of average home property assessments (averages are not necessarily indicative of individual properties or neighborhoods)

¨ Countywide average for all homes – $547,219, up 2.17%

¨ Single family-detached homes – $656,071, up 2.11 %

¨ Townhouse/duplex properties – $409,792, up 2.86 %

¨ Condominiums – $264,974, up 1.68 percent

Residential assessments in Annandale rose an average of 2.77 percent, the third highest increase in the county only outflanked by Burke at 3.22% and Springfield at 3.41%. Last year, a decline in assessed value was recorded for Oakton, Reston, Great Falls and McLean.

County Executive Bryan Hill testified that county revenues are tepid while growth of both low income families and elderly residents on fixed incomes were impacting revenues. cautioned restrained spending and that the county would need to learn to do more with less until and unless more business moves into the county and federal government spending in the county rises. To date, improvements are being delayed on roads, parks and infrastructure. But county employees and teachers will receive pay raises, and funds for the opioid crisis and early childhood education for those who can’t afford private preschool are strongly proposed.

Hill wishes to make the county more efficient by cutting county expenses and has asked county staff to eliminate duplicative services and programs. He went on to say, “We cannot have residential tax increases each and every year. My hope is that by 2020 we will live within our means without increasing the tax rate." What an enlightened perspective and one most welcome by the taxpayer who has said so often, ENOUGH IS ENOUGH! It might also be time to explore if certain county departments are no longer relevant to the needs of county residents or may not have performed to their mission objective. If so, dissolve these offices.

(Copyright © 2012 Annandale Chamber of Commerce. All rights reserved. (Photographs & images, on this page, and on this website, are not available for use by other publications, blogs, individuals, websites, or social media sites.)

Copyright 2012 Annandale Chamber of Commerce. All rights reserved. Privacy Policy