Fairfax County Land Use

Establishes New Program to Encourage Economic Growth

Fairfax County adopted a new program on Sept. 15, 2020, that provides economic incentives to the private sector for the revitalization and redevelopment of properties in select commercial areas. Called the Economic Incentive Program (EIP), this program encourages economic growth by providing multiple financial and regulatory incentives.

Fairfax County adopted a new program on Sept. 15, 2020, that provides economic incentives to the private sector for the revitalization and redevelopment of properties in select commercial areas. Called the Economic Incentive Program (EIP), this program encourages economic growth by providing multiple financial and regulatory incentives.

Financial incentives for the EIP include a ten percent reduction of site plan fees and a partial abatement of the real estate taxes on the difference between the base value of a property and its post-development value, including any increase or decrease in the annual assessed value of the tax-exempt portion of the property.

The EIP’s regulatory incentives include expedited scheduling of zoning applications and concurrent processing of a Comprehensive Plan amendment and zoning application, and concurrent processing of a site plan with a zoning application.

To qualify for the Economic Incentive Program, development proposals must meet the following criteria:

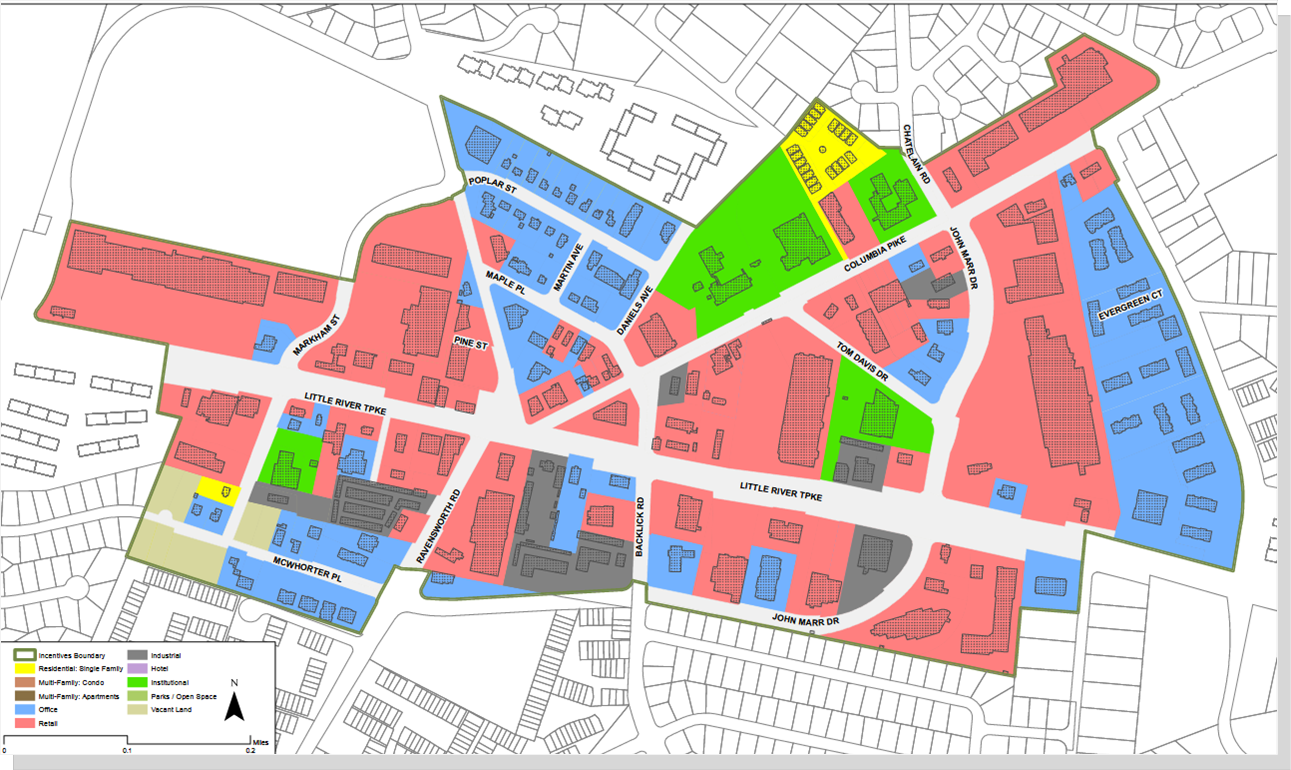

- Proposal location is within one of six designated areas, which are: the Commercial Revitalization Districts (CRDs) of Annandale, Baileys Crossroads/Seven Corners, and McLean; the Lincolnia Commercial Revitalization Area (CRA); the Richmond Highway CRD and Suburban Neighborhood Areas, and a portion of the Huntington Transit Station Area (TSA); and, the Springfield CRD and TSA (non-single-family portion of the TSA).

- The proposed development must be commercial, industrial, and/or multi-family residential.

- The proposal must include a newly proposed assemblage, not previously submitted for rezoning or site plan approval of at least 2 contiguous parcels totaling a minimum of two acres. However, the Board of Supervisors may make an exception regarding the minimum size of the consolidation.

- The proposal must be consistent with the consolidation and use recommendations of the Comprehensive Plan, and all laws and policies related to the provision and preservation of affordable housing.

Each of the six designated areas for the EIP has a specified ten-year timeframe in which eligible development can receive the partial real estate tax abatement. For Annandale, the time frame is January 1, 2025 to December 31, 2034. This timeframe is the period within which a qualifying property will be able to avail themselves of the partial real estate tax abatement. The partial real estate tax abatement does not extend beyond the specified timeframes, regardless of when a property becomes qualifying.

For additional information about the Economic Incentive Program, visit www.fcrevite.org/economic-incentive-program .

(Copyright © 2012 Annandale Chamber of Commerce. All rights reserved. (Photographs & images, on this page, and on this website, are not available for use by other publications, blogs, individuals, websites, or social media sites.)

Copyright 2012 Annandale Chamber of Commerce. All rights reserved. Privacy Policy