Real Estate Tax Assessments

UP 10.24% in Annandale

The frenzied purchasing of residential real estate during and mostly because of Covid, has driven residential real estate prices so high as not to be sustainable. If you were one of the many who did not change homes in the past few years, you are going to face this rapid assessment increase without any benefit. Every 7-8 years a real estate cycle is all but predictable. Prices go up, then they remain relatively level and then they fall. Mortgage interest rates are rising which will likely discourage some buyers and eliminate others cooling the temporary fevered pitch of the market. In the meantime, assessments rise without any digestible relief in the tax rate. Homeowners, funding the majority of county spending, will again see their wallets emptied without realizing any tangible gain in government services. Over the past year county coffers swelled with Covid funds and significantly higher real estate tax collection. Since counties are required to zero out their budgets each year, spending became epidemic. Now is the time for the county to curb spending on their want list rather than their need list and give the tax payer a substantial drop in the tax rate.

Do the simple math for yourself. Annandale is experiencing a higher than county average increase. Look at last year’s assessment and increase it by 10.24% or wait for your assessment which should be arriving soon. First, sit down and take a deep breath then do the math.

(Assessed Value ÷ 100) × 2022 Proposed Base Tax Rate of $1.140 = Your Tax Amount)

TAX RATES NEARBY

Arlington County

Assessed values increased by 5.8% Tax Rate 1.013 / $100 assessed value

City of Alexandria

Assessed values increased by 5.36% Tax Rate 1.110 / $100 of assessed value

Fairfax County

Assessed values increased by 9.57% (average) Tax Rate 1.140 / $100 of assessed value

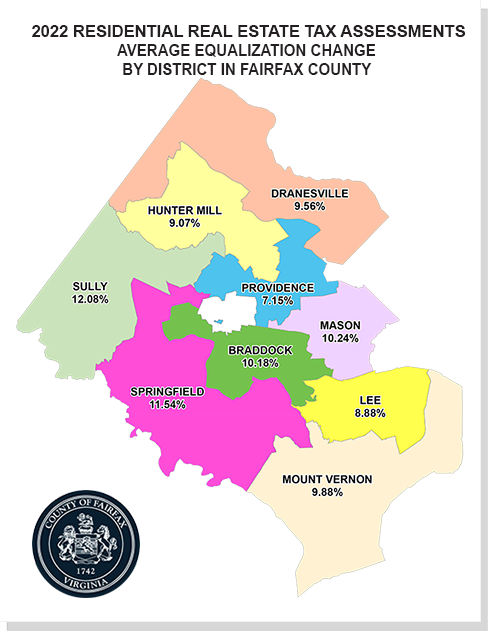

Almost 357,000 updated 2022 real estate assessments notices are being mailed to all property owners. Based on equalization changes according to the county (market-driven value increases or decreases), countywide residential real estate assessments are up an average of 9.57%, with the average assessment for all homes at $668,974. In 2021, the countywide average home assessment was $610,545.

In 2021, residential housing prices increased in most areas of the county because of record low interest rates, low housing inventory and high demand. Retail, apartment, hotel and industrial properties also increased in value, but high-rise offices declined in value as remote work continues to be the norm.

92% OF HOME VALUES ARE UP

Of the total number of residential properties, 92% increased in value due to equalization which is market-driven increases or decreases in value. Only 2.8% saw a decrease in value, and assessments are unchanged for the remaining 5.2%.

The breakdown of average home assessments is shown below. Please note that averages are not necessarily indicative of individual properties or neighborhoods.

- Condominiums – $320,940, up 3.98%

- Single-family detached homes – $807,450, up 10.86%

- Townhouse/duplex properties – $501,743, up 8.70%

Meanwhile, non-residential real estate values (commercial, industrial and rental apartments) increased by 2.27% on average. Overall, of the 356,967 taxable parcels in Fairfax County: 334,334 have an assessment change.

WHY YOUR ASSESSMENT MAY HAVE CHANGED

There are several factors that affect real estate assessments:

- Sales in the neighborhood.

- Economic factors such as average number of days homes have been for sale and sales volume.

- Improvements to the property (remodeling, additions).

- New construction and rezoning.

- Property characteristics, such as size, age, condition and amenities.

Sarcastically tax payers are told they can always appeal their real estate assessment. Good luck even if you can get through to a county office in real time. Lowering the assessment which is based on 100% of market valuations, is not only teeth chattering difficult but rarely possible nor will you see those assessments roll back in a bad market. The only thing your elected officials can do for you is to LOWER the tax rate itself. As noted above, Fairfax County has a very high rate.