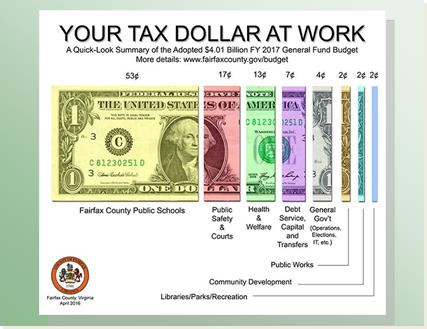

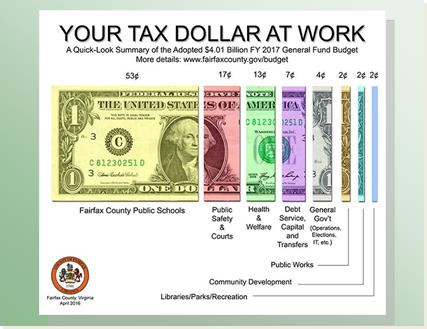

Your Tax Dollars at Work

Fairfax County 2017 Budget

- Fairfax County Public Schools: 53 cents (WOW! Maybe it is time for an independent outside audit & review of the school system)

- Public Safety and Courts: 17 cents

- Health and Welfare: 13 cents

- Debt Service,

Capital and Transfers: 7 cents

Capital and Transfers: 7 cents - General Government, which includes operations, elections and IT: 4 cents

- Public Works: 2 cents

- Community Development: 2 cents

- Libraries, Parks and Recreation: 2 cents

Tax Rate Increase

The Fairfax County Board of Supervisors voted for a real estate tax rate increase based on community input for increased funding for schools, public safety and human services. The rate is increasing four cents from $1.09 to $1.13, per $100 of the assessed value of your home, with the actual tax increasing further based on the substantial increase in property assessments.

The County claims that homeowners on average will pay an additional $304 in their real estate taxes next year. In Annandale and the inner suburbs, the average increase is expected to be at least twice that estimate. At this rate, our wise and graying population will be forced to move out of Fairfax County. Annual steep tax increases placed on the backs of the property owners has gone too far. Fairfax County, indeed the Commonwealth of Virginia, must find revenue from other sources OR make the cuts necessary, including looking at the schools. Perhaps an athletic fee must be instigated with Booster Clubs putting in extra effort to raise funds for those students who absolutely can't afford the fee. It is only fair that the student or their parents come up with the fee rather than the overly stretched homeowner be obligated to take on another extra part time job to pay this outlandish increase in real estate taxes. (The latest data shows that less than 1% of all high school athletes ever make it to the professional leagues, and less that 3% are offered college scholarships based on their athletic prowess alone.) To view your current real estate tax amount , go to www.fairfaxcounty.gov/dta/

The real estate tax increase will generate an additional $93 million for the county next year.

School Funding Increased by More Than 5 Percent (The Schools have gained a well earned reputation for fiscal overgrabbing...more than $88 million in over budget funds remained at the end of the last two school years, yet they have not been forced to give it back or refund the taxpayer.)

- The Board of Supervisors voted to provide an additional $33.6 million in funding to our Fairfax County Public Schools (FCPS) above the amount in the county executive’s proposed budget.

- Funding for FCPS will increase more than 5 percent increase over the FY 2016 budget.

- FCPS will receive 52.7 percent of the county’s $4.01 billion General Fund budget, which equals $2.12 billion. The increase is possible due to a portion (one cent) of the real estate tax rate increase, as well as funds that were available through a reallocation from the third quarter review of the current FY 2016 budget.

- Additional county support of FCPS such as school crossing guards, school resource officers and the school health program totals $85 million and when combined with the funding mentioned above brings FCPS support to 54.9 percent of the county’s General Fund Budget.

- The Board of Supervisors also worked closely with the Virginia General Assembly during its 2016 session, which increased funding to FCPS by $16.8 million.

Funding to Support Public Safety Priorities

$7.5 million was approved to be used to fund recommendations by the Ad-Hoc Police Practices Review Commission. This includes:

- $3.89 million and 19 positions for the Diversion First program, a collaborative effort to reduce the number of people with mental illness in the county jail.

- $1.2 million to fund 15 percent salary supplements for eligible General District Court and Juvenile and Domestic Relations District Court staff, as well as increases for the Office of the Public Defender to raise their salaries to a level consistent with their counterparts in the Office of the Commonwealth’s Attorney.

- The remaining $2.41 million will be held in reserve and is expected to be used as part of the estimated $35 million multi-year cost of the recommendations from the Ad-Hoc Police Practices Review Commission.

Budget Reductions Were Made

Reductions were made from the current FY 2016 budget totaling $13.63 million, as well as 17 fewer positions. Among the reductions:

- $10 million due to the implementation of an Employer Group Waiver Plan for Medicare retiree prescription drug coverage.

- $3 million based on ongoing analysis of current county fuel costs and usage.

- $0.20 million based on efficiencies generated through the telecommunication billing process.

- $.015 million savings generated from annual review of flexibility in General Fund agencies as a result of existing staffing and salary levels.

Annandale Chamber of Commerce

(Copyright © 2012 Annandale Chamber of Commerce. All rights reserved. (Photographs & images, on this page, and on this website, are not available for use by other publications, blogs, individuals, websites, or social media sites.)

Copyright 2012 Annandale Chamber of Commerce. All rights reserved. Privacy Policy

Capital and Transfers: 7 cents

Capital and Transfers: 7 cents